what is fsa health care 2020

Dentistry pharmacy midwifery. Ad We Beat Any Price on Contacts.

Health Care Flexible Spending Accounts Human Resources University Of Michigan

A Health Care Flexible Spending Account FSA allows you to set aside tax-free dollars each year for health care expenses not covered by insurance.

. We Have Your Lenses In Stock-Fast Shipping. Short Term and TriTerm Medical Dental More. You can contribute up to 2750 in 2021 and 2850 in 2022 into your Healthcare FSA.

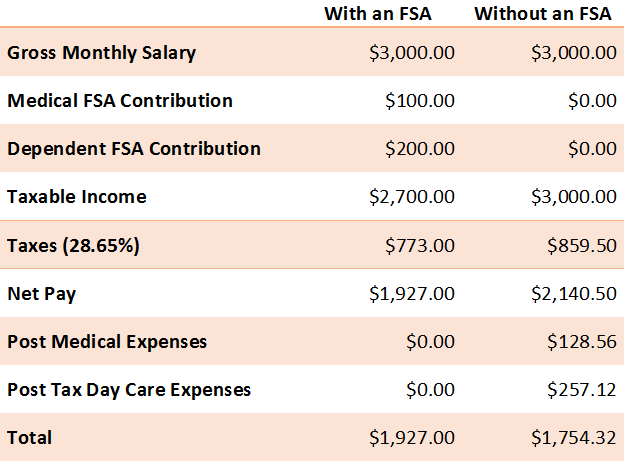

The most significant difference between flexible spending accounts FSA and health savings accounts HSA is that an individual controls an HSA and allows contributions to roll over while FSAs are less flexible and are owned by an employer. The limit for health FSAs in 2021 is 2750 unchanged from 2020 and unaffected by the latest stimulus bill. Second your employers contributions wont count toward your annual FSA contribution limits.

Ad Shop Golden Rule Ins Co Plans Packages. Basic Healthcare FSA Rules. Explore Plan Comparisons Instantly.

You dont pay taxes on this money. Get a Quote Now. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere.

Employers may make contributions to your FSA but arent required toA Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocketout-of-pocketYour expenses for. An FSA or flexible spending account is an employer-sponsored healthcare benefit that allows employees to set aside up to 2850 2022 annually to cover the cost of qualified medical expenses. Physicians and doctor partners are a part of these health professionals.

A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. The limit for health FSAs in 2021 is 2750 unchanged from 2020 and unaffected by the latest stimulus bill. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

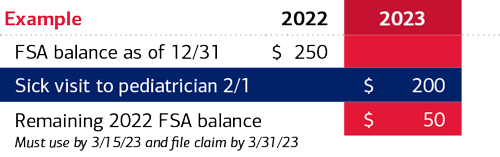

Get Help Quotes from a Local Agent. If youre married and both you and your. Separately the rules regarding carrying over unused FSA funds from one year to the next have changed for now.

More Health Reimbursement Arrangement HRA. While you cant use FSA funds to pay insurance premiums you can use them to pay for expenses such as deductibles medical equipment such as crutches and even medical supplies such as bandages and blood sugar test kits. Easiest Way to Order Contacts.

Ad 2022 Health Insurance Plans are Here. You can use your Health Care FSA HC FSA funds to pay for a wide variety of health care products and services for you your spouse and your dependents. You decide how much to put in an FSA up to a limit set by your employer.

The most significant difference between flexible spending accounts FSA and health savings accounts HSA is that an individual controls an HSA and allows contributions to roll over while FSAs are less flexible and are owned by an employer. 2020 FSA Contribution Cap Rises to 2750. A healthcare flexible spending account FSA is an employer-owned employee-funded savings account that employees can use to pay for eligible healthcare expenses.

Allowed expenses include insurance copayments and deductibles qualified prescription drugs insulin and medical devices. 16 In 2020 thanks to the Coronavirus Aid Relief and Economic Security CARES Act the list of eligible expenses that can be reimbursed through an FSA was. An FSA is a type of savings account that provides tax advantages.

This means youll save an amount equal to the taxes you would have paid on the money you set aside. Here is a breakdown of how an FSA and HSA differ. The Taxpayer Certainty and Disaster Tax Relief Act of 2020 signed into law on December 27 2020 provides similar flexibility for these arrangements in 2021 and 2022.

A Health Care Flexible Spending Account FSA is a type of employee benefits plan that allows employees to designate a specified amount of pre-tax dollars to go towards plan-approved medical expenses. Maximize the Value of Your Reimbursement Account - Your Health Care Flexible Spending Account FSA andor Health Reimbursement Account HRA dollars can be used for a variety of out-of-pocket health care expenses that qualify as federal income tax deductions under Section 213d of the Internal Revenue Code IRC. The IRS determines which expenses can be reimbursed by an FSA.

For single filers the limit is 5250 up from 2500. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars. A flexible spending account FSA is a type of savings account usually for healthcare expenses that sets aside funds for later use.

Employers may make contributions to your FSA but arent required to. For Short Term Plans That Go a Long Way To Helping You Find Coverage. You can use the money in your FSA to pay for many healthcare expenses that you incur.

Its a lot like a savings account but used for qualified health-related costs. The Taxpayer Certainty and Disaster Tax Relief Act of 2020 signed into law on December 27 2020 provides similar flexibility for these arrangements in 2021 and 2022. Healthcare health-care or health care is the maintenance or enhancement of health by means of the avoidance diagnosis treatment recovery or remedy of illness disease injury and other physical and mental disabilities in individuals.

There are a few things to remember when it comes to establishing and then spending from your Healthcare FSA. What is the difference between health care FSA and HSA. Ad Custom benefits solutions for your business needs.

The Flexible Spending Account FSA is a much sought-after benefit in 2021 as people return to doctors and hospitals for treatment they delayed receiving in 2020 because of the pandemic. Your Health Care FSA covers hundreds of eligible health care services and products. Never Run Out of Contacts.

Some of these expenses include dental vision medical exams deductibles co-pays and prescription costs. Get a free demo. What items are FSA eligible 2020.

Elevate your health benefits. For 2021 you can contribute. Easy implementation and comprehensive employee education available 247.

What is the FSA amount for 2020. Its a smart simple way to save money while keeping you and your family healthy and protected. Key Takeaways About Your Fsa In 2020 Medical Prescription Health Insurance Broker Employee Benefit.

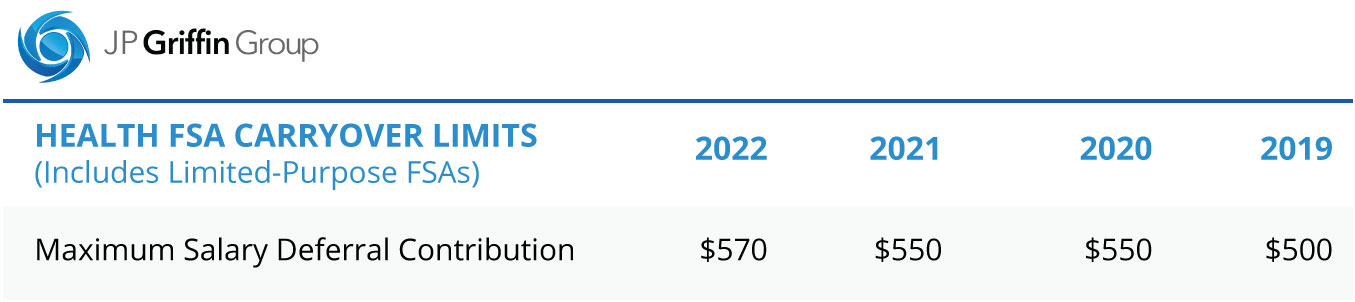

Employees can put an extra 50 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov. When used it can be a great tax savings tool to effectively pay for qualified out-of-pocket expenses whether related to. Separately the rules regarding carrying over unused FSA funds from one year to the next have changed for now.

Millions of employees have access to health FSAs and dependent care assistance programs sponsored by. If an employee enrolled in this type of FSA. For 2021 you can contribute up to 2750 to a healthcare FSA.

What is a health savings account vs flexible spending account.

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Hsa Vs Fsa Which Is Better Comparison Chart Included Health Savings Account Flex Spending Account Health Insurance Humor

Fsa Carryover What It Is And What It Means For You Wex Inc

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

Health Care Flexible Spending Account University Of Colorado

/GettyImages-629388550-e4fd4d3f5b094ad099fb0d68e42e2d4c.jpg)

Does Money In A Flexible Spending Account Fsa Roll Over

Hsa And Fsa Accounts What You Need To Know Readers Com

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

What Is A Medical Flexible Spending Account Healthinsurance Org

Understanding The Year End Spending Rules For Your Health Account

How To Use Your Fsa For Skincare California Skin Institute

Hsa Vs Fsa What S The Difference Quick Reference Chart

What Is A Medical Flexible Spending Account Healthinsurance Org

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

What Is A Health Care Flexible Spending Account Or Fsa And Can I Use It To Pay For Chiropractic Care Precision Spinal Care