rhode island income tax rate 2020

The Rhode Island tax rate is unchanged from last year however the income tax brackets increased due to the annual. Your 2021 Tax Bracket to See Whats Been Adjusted.

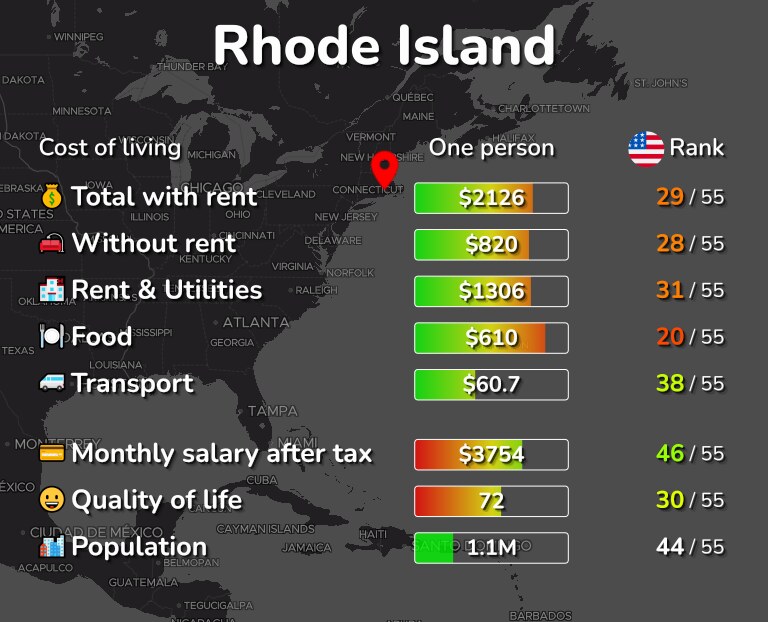

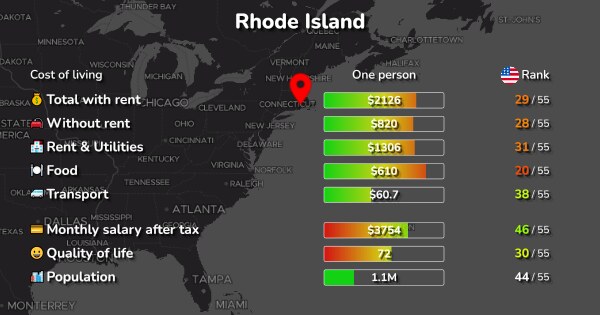

Cost Of Living Prices In Rhode Island 18 Cities Compared

The rhode island state state tax calculator is updated to include the latest state tax rates for 20212022 tax year and will be update to the 20222023 state tax tables once fully published as published by the various states.

. The combined rate used in this calculator 7 is the result of the rhode island state rate 7. 2020 Due Date. Rhode Island has three marginal tax brackets ranging from 375 the lowest Rhode Island tax bracket to 599 the highest Rhode Island tax bracket.

Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in Rhode Island for single filers and couples filing jointly. How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table. To receive free tax news updates send an e-mail with SUBSCRIBE in subject line.

Find your income exemptions. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021. Check the status of your state tax refund.

RI-1040H 2021 2021 RI-1040H Rhode Island Property Tax Relief Claim PDF file about 2 mb megabytes RI-1040MU 2021 Credit for Taxes Paid to Other State multiple PDF file less than 1 mb megabytes RI-1040NR 2021 Nonresident Individual Income. Nonresidents and part-year residents will file their Rhode Island Individual Income Tax Returns using Form RI-1040NR. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

Rhode Island Division of Taxation. Ad Answer Simple Questions About Your Life And We Do The Rest. 639413 599 148350 Page i.

RI 1040 H Only. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Discover Helpful Information and Resources on Taxes From AARP.

2020 Rhode Island Tax Deduction Amounts. Directions Google Maps. The Rhode Island Single filing status tax brackets are shown in the table below.

Tax Rate 0. 2020 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Find your pretax deductions including 401K flexible account contributions.

It is the basis for preparing your Rhode Island income tax return. The thresholds separating Rhode Islands three income tax brackets are to increase to 65250 and 148350 up from 64050 and 145600 the division said in a notice. For example if your expected refund is.

Rhode Islands income tax brackets were last changed one year prior to 2020 for tax year 2019 and the tax rates were previously changed in 2009. Over But not over Pay percent on excess of the amount over 0 65250 -- 375 0 65250 148350 244688 475 65250 148350 -- 639413 599 148350. Enter here and on form RI-1040 or RI-1040NR Page 1 line 4 8.

Multiply line 1 by line 7. TurboTax Makes It Easy To Get Your Taxes Done Right. In gen-eral the Rhode Island income tax is based on your federal adjusted gross income.

Complete your 2021 Federal Income Tax Return first. These income tax brackets and rates apply to Rhode Island taxable income earned January 1 2020 through December 31 2020. RHODE ISLAND TAX RATE SCHEDULE 2020 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 65250 148350 But not over Pay--of the amount over 244688 639413 375 475 599 on excess 0 65250 148350.

Rhode Island Single Tax Brackets. The Rhode Island Married Filing Jointly filing status tax brackets are shown in the table below. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020.

No Tax Knowledge Needed. Check the 2020 Rhode Island state tax rate and the rules to calculate state income tax. 2020 Tax Rate Schedule - FOR ALL FILING STATUS TYPES Taxable Income from RI-1040 or RI-1040NR line 7 Over 0 65250 But not over Pay---of the amount over 244688 375 475 on excess 0 65250 148350 65250 148350.

65250 148350 CAUTION. Find your gross income. Detailed Rhode Island state income tax rates and brackets are available on.

Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. Head of household 13550. These income tax brackets and rates apply to Rhode Island taxable income earned January 1 2020 through December 31 2020.

You filed your tax return now - Wheres My Refund. The amount of your expected refund rounded to the nearest dollar. File With Confidence Today.

Rhode Island has a flat corporate income tax rate of 7000 of gross income. Some Rhode Island tax-related amounts for 2020 including income tax bracket thresholds and the standard deduction were released Nov. 13 2019 123 PM.

Guide to tax break on pension401kannuity income. Subscribe for tax news. INCOME TAX AND CREDITS Using a paper clip please attach Forms W-2 and 1099 here.

Uniform tax rate schedule for tax year 2020 personal income tax Taxable income. Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that.

The federal corporate income tax by contrast has a marginal bracketed corporate income taxThere are a total of twenty four states with higher marginal corporate income tax rates then Rhode Island. The income tax is progressive tax with rates ranging from 375 up to 599. Rhode Island Standard Deduction Single 9050 Married filing jointly or Qualifying widower 18100 Married filing separately 9050 RI income tax from Rhode Island Tax Table or Tax Computation Worksheet.

13 by the state taxation division. One Capitol Hill Providence RI 02908. Ad Compare Your 2022 Tax Bracket vs.

Prepare And Efile Your 2021 2022 Rhode Island Tax Return

Historical Rhode Island Tax Policy Information Ballotpedia

Discover 20 Of The Most Interesting Facts Of Rhode Island Economic Ones Too

Rhode Island Income Tax Calculator Smartasset

Rhode Island Estate Tax Everything You Need To Know Smartasset

When And Where To File Your Tax Return In 2018 Tax Return Tax Paying Taxes

Climate Change In Rhode Island Wikipedia

Rhode Island Sales Tax Guide And Calculator 2022 Taxjar

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

Rhode Island Income Tax Calculator Smartasset

Rhode Island Retirement Taxes And Economic Factors To Consider

Rhode Island Medical Marijuana Wholesale Market On Upswing Monopoly Questions Remain

Rhode Island Income Tax Calculator Smartasset

Rhode Island Income Tax Brackets 2020

Renewable Energy Solar Rhode Island Office Of Energy Resources